The firms have obtained conditional approval from the Office of the Comptroller of the Currency to convert into national trust banks.

Updated Dec 12, 2025, 6:03 p.m. Published Dec 12, 2025, 4:39 p.m.

Five digital asset firms have received conditional approvals Friday to become federally chartered trust banks by the Office of the Comptroller of Currency (OCC) in a major step to bring U.S. dollar stablecoin issuers under federal regulatory oversight.

Blockchain firm Ripple and Circle’s (CRCL) First National Digital Currency Bank are on the list, which also includes BitGo, Fidelity Digital Assets and Paxos, each having previously operated under state charters that will be converted to conditional federal status.

The OCC is the only federal agency that charters banks and trusts, and this surge in approvals potentially marks a major turning point in crypto banking. Since the arrival of President Donald Trump’s administration, the regulator — run by his appointee, Jonathan Gould — has shifted from a crypto-resistant stance to a friendly approach.

“The OCC will continue to provide a path for both traditional and innovative approaches to financial services to ensure the federal banking system keeps pace with the evolution of finance and supports a modern economy,” Gould said in a statement.

If the newly approved trust banks can meet agency expectations, they’ll permanently join about 60 regulated institutions with such charters, which allow for fiduciary activities including custody. National trust banks — a category that includes the first chartered crypto bank, Anchorage Digital — have certain limits in their business activities, so they don’t offer the same deposit and lending capabilities as the OCC’s larger pool of national banks.

‘Huge news’ for crypto, Ripple’s Garlinghouse says

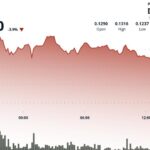

Ripple chief executive officer Brad Garlinghouse said in an X post that the OCC’s move is “huge news,” a “massive step” for the firm’s $1.3 billion RLUSD$0.9999 stablecoin. He also slammed the bank lobby for their “anti-competitive tactics.”

“You’ve complained that crypto isn’t playing by the same rules, but here’s the crypto industry — directly under the OCC’s supervision and standards — prioritizing compliance, trust and innovation to the benefit of consumers,” Garlinghouse said. “What are you so afraid of?”

Circle, the issuer of the $78 billion stablecoin USDC$0.9998, said in a press release that the national trust bank charter would “enhance the safety and regulatory oversight of the USDC Reserve, while enabling Circle to offer fiduciary digital asset custody and related services to institutional customers.”

Paxos, the company behind the $3.8 billion PYUSD$0.9997 and the consortium-backed, $1.4 billion Global Dollar token (USDG), said that its federally regulated platform would “allow businesses to issue, custody, trade and settle digital assets with clarity and confidence.” Notably, Paxos has been operating under a New York Department of Financial Service (NYDFS) charter since 2015, and first applied for federal charter in 2020.

Mike Belshe, CEO of BitGo, said that the development “marks an official end to the war on crypto and the beginning of the next era of innovation in banking,” adding that “we’ve entered the era of regulatory integration, and improvements will continue to happen fast.” BitGo is the issuer behind USD1 (USD1), the digital dollar token of World Liberty Financial, a crypto project with close ties to the Trump family.

The crypto sector has long struggled with banking in the U.S., including a prolonged fight against regulators and large institutions that the industry accused of systemically debanking their companies and executives. The Trump administration has sought to reverse any policies and banking activity that adversely targeted crypto firms.

The OCC issued a report on Thursday about debanking, arguing that all nine of the largest banks were involved and that those guilty of severing banking ties to legal business customers could face punishment.

UPDATE (December 12, 2025, 16:59 UTC): Adds comments from two of the involved companies.

UPDATE (December 12, 2025, 17:06 UTC): Adds information on the OCC’s debanking report.

UPDATE (December 12, 2025, 17:16 UTC): Adds comment from Ripple’s CEO.

UPDATE (December 12, 2025, 17:37 UTC): Adds comment from BitGo’s CEO.

More For You

Protocol Research: GoPlus Security

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

Citadel Securities and DeFi Waging War of Words Through SEC Correspondence

The investing giant had asked the U.S. Securities and Exchange Commission to treat DeFi players like regulated entities, and the DeFi crowd pushed back.

What to know:

- A feud conducted over U.S. Securities and Exchange Commission (SEC) correspondence has developed between Citadel Securities and the DeFi sector, arguing over whether DeFi protocols should be more regulated.

- The DeFi space is calling out the investment firm for its approach to the securities regulator.