The token has major support at the $1.36 level and resistance at $1.40.

Dec 12, 2025, 2:20 p.m.

Filecoin dropped 0.2% to $1.37 over the last 24 hours as the token underperformed the wider crypto markets.

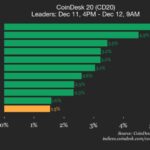

The broader market gauge, the CoinDesk 20 index, was 3% higher at publication time.

FIL trading activity jumped 29% above the seven-day average, signaling heightened institutional interest, according to CoinDesk Research’s technical analysis model.

The elevated volumes suggested smart money repositioning, with buyers stepping in at key technical levels, the model showed.

Filecoin traded to a session high of $1.397 before distribution pressure mounted during the last hour, according to the model.

The move established new short-term resistance near $1.40 and support at $1.36.

Technical Analysis:

- Resistance formed at $1.40 session high

- Trading activity peaked at 5.9 million tokens during the 21:00 hour on Dec. 11, 68% above 24-hour averages.

- Final hour distribution pressure generated 642,087 tokens in volume during the breakdown sequence.

- Higher lows at $1.3577 and $1.3661 suggested underlying accumulation despite sector headwinds.

- Immediate upside targets at $1.3975 resistance and $1.40 psychological level.

- Downside risk extended to $1.39 session open, with major support zone beginning near $1.36 from the previous consolidation low.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Protocol Research: GoPlus Security

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

These Three Metrics Show Bitcoin Found Strong Support Near $80,000

Onchain data shows multiple cost basis metrics confirm heavy demand and investor conviction around the $80,000 price level.

What to know:

- Bitcoin rebounded from the $80,000 region after a sharp correction from its October all time high, with price holding above the average entry levels of key metrics.

- The convergence of the True Market Mean, U.S. ETF cost basis, and the 2024 yearly cost basis around the low $80,000 range highlights this zone as a major area of structural support.